Understanding the Rising Cost of Health Insurance

The cost of health insurance has been on the rise in recent years, making it increasingly important to understand the factors influencing these costs and their impact on individuals. This section will explore the key factors driving the rising cost of health insurance plans and the challenges individuals face as a result.

Factors Influencing Health Insurance Costs

Medical Inflation and Technological Advances

Medical inflation and rapid technological advances in healthcare contribute significantly to the increasing cost of health insurance. The development of new medical treatments, medications, and technologies often comes with a hefty price tag, which gets passed on to insurance providers and, ultimately, policyholders.

Demographic Factors and Risk Assessment

Demographic factors, such as an aging population and an increase in chronic health conditions, play a role in driving up health insurance costs. As the demand for healthcare services grows, insurance companies must account for the higher risk associated with certain age groups and medical conditions, leading to higher premiums.

Administrative and Overhead Expenses

Administrative and overhead expenses also contribute to the rising cost of health insurance. Insurance companies incur various operational costs, including administrative staff salaries, marketing expenses, and regulatory compliance, which are factored into the premiums charged to policyholders.

The Impact of Increasing Health Insurance Costs on Individuals

The escalating cost of health insurance has several implications for individuals and families seeking coverage.

Affordability Challenges

As health insurance premiums rise, affordability becomes a significant concern for many individuals. The increasing financial burden can make it difficult for people to allocate funds for other essential expenses or save for the future.

Limited Coverage Options

The rising cost of health insurance has led to limited coverage options, with some insurers reducing benefits or narrowing their networks of healthcare providers. This limited choice can make it challenging for individuals to find insurance plans that meet their specific needs.

Financial Burden and Risk Exposure

Individuals without adequate health insurance coverage may face significant financial burdens if they require medical treatment or face unexpected health issues. Without sufficient coverage, they are at risk of incurring high out-of-pocket expenses or even medical debt.

Navigating the World of Health Insurance Plans

Understanding the different types of best health insurance plans available and considering key factors when choosing a plan are crucial steps in protecting both your health and wallet. This section will provide insights into various health insurance plan types and offer guidance on selecting the most suitable option.

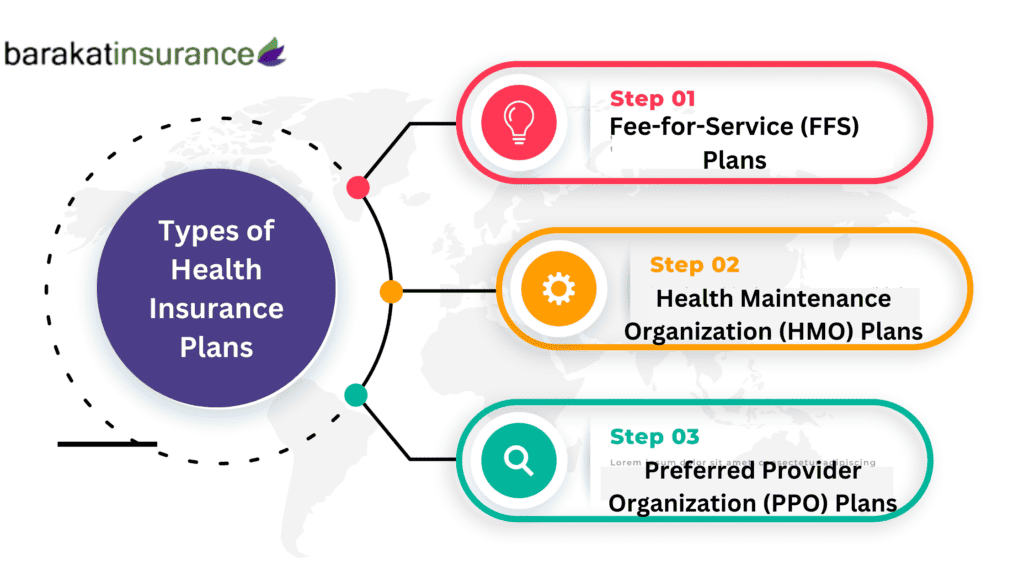

Types of Health Insurance Plans

When exploring health insurance options, it’s important to familiarize yourself with different plan types. The following are three common types of health insurance plans:

Fee-for-Service (FFS) Plans

Fee-for-Service plans allow policyholders to choose their healthcare providers. Under this plan, insurance companies reimburse a percentage of the total charges for covered services, and policyholders pay the remaining portion.

Health Maintenance Organization (HMO) Plans

Health Maintenance Organization (HMO) plans generally require policyholders to select a primary care physician (PCP) and obtain referrals to see specialists. HMOs often provide comprehensive coverage and emphasize preventive care.

Preferred Provider Organization (PPO) Plans

Preferred Provider Organization (PPO) plans offer more flexibility than HMOs. Policyholders can visit both in-network and out-of-network healthcare providers without a referral, although higher out-of-pocket costs may apply for out-of-network services.

Key Considerations When Choosing a Health Insurance Plan

Several key factors should be considered when evaluating health insurance plans:

Coverage Options and Benefits

Review the coverage options and benefits provided by each plan. Ensure that essential services and treatments are included, such as preventive care, prescription drugs, specialist visits, and hospitalization.

Network of Providers

Consider the network of healthcare providers associated with each plan. Check if your preferred doctors, hospitals, and specialists are included in the plan’s network to ensure convenient access to the healthcare professionals you trust.

Out-of-Pocket Costs and Deductibles

Assess the out-of-pocket costs associated with each plan, including deductibles, copayments, and coinsurance. Evaluate how these costs align with your budget and healthcare needs.

The Role of Health Insurance Brokers in Florida

Health insurance brokers in Florida can be valuable resources when navigating the complexities of health insurance. They can help you understand your options, compare plans, and find the most suitable coverage for your needs.

Benefits of Working with a Health Insurance Broker

Health insurance brokers have expertise in the insurance market and can provide personalized guidance based on your unique circumstances. They can simplify the process of finding and enrolling in a health insurance plan and help you understand the terms and conditions of different policies.

How to Find a Reliable Health Insurance Broker in Florida

To find a reliable health insurance broker in Florida, consider the following steps:

1.Ask for recommendations from friends, family, or colleagues who have worked with brokers in the past.

2.Research online directories and professional associations that list reputable brokers.

3.Verify the broker’s credentials and licenses to ensure they are authorized to provide insurance advice in Florida.

4.Schedule a consultation with potential brokers to assess their knowledge, experience, and communication style.

Questions to Ask a Health Insurance Broker

When consulting with a health insurance broker, consider asking the following questions:

- What types of health insurance plans do you specialize in?

- Can you explain the differences between the plans you recommend?

- How do you assist with claims and resolving insurance-related issues?

- Are you familiar with any subsidies or financial assistance programs that may be available to me?

- How do you ensure that the plan you recommend aligns with my budget and healthcare needs?

Investing in Health Insurance: A Smart Approach

Investing in health insurance is a wise decision that provides essential protection, access to quality healthcare, and peace of mind. This section explores the importance of health insurance, tax benefits, and strategies for finding affordable coverage.

Understanding the Importance of Health Insurance

Health insurance offers several significant benefits that make it a crucial investment:

- Protection Against High Medical Costs

Health insurance safeguards you from incurring exorbitant medical expenses in case of accidents, illnesses, or chronic conditions. It helps cover the costs of doctor visits, hospital stays, medications, surgeries, and other necessary treatments.

- Access to Quality Healthcare Services

With health insurance, you gain access to a network of healthcare providers who can deliver timely and appropriate medical care. Regular check-ups, preventive services, and screenings contribute to maintaining good health and catching potential issues early.

- Peace of Mind and Financial Security

Having health insurance provides peace of mind, knowing that you have a financial safety net in case of unexpected health issues. It offers protection against the potential burden of medical debt and allows you to focus on your well-being without worrying about significant financial setbacks.

Maximizing Tax Benefits through Health Insurance

Understanding the tax benefits associated with health insurance can help you make informed decisions and potentially reduce your tax liability.

- Overview of Health Insurance Tax Deductions

In many countries, including the United States, health insurance premiums may be tax-deductible. This means you can deduct the amount you pay for health insurance from your taxable income, potentially lowering your overall tax liability.

- Eligibility Criteria for Tax Deductions

The eligibility criteria for health insurance tax deductions vary by country and specific tax regulations. Generally, self-employed individuals, employees who are not offered employer-sponsored health insurance, and individuals who meet certain income thresholds may qualify for tax deductions

- .Shopping Around for Competitive Quotes

To find affordable health insurance coverage, it’s essential to compare quotes from different insurance providers. This allows you to evaluate costs, benefits, and coverage options to make an informed decision.

- Researching Health Insurance Providers

Start by researching reputable health insurance companies in your area. Look for companies with a strong reputation, positive customer reviews, and a wide network of healthcare providers.

- Assessing Quotes and Comparing Plans

Request quotes from multiple insurance providers based on your specific needs and preferences. When comparing plans, consider factors such as monthly premiums, deductibles, copayments, coinsurance, coverage limits, and included benefits. Assess how these factors align with your budget and healthcare requirements.

- Seeking Assistance from Health Insurance Brokers

Health insurance brokers can assist you in obtaining competitive quotes from multiple insurers. They have access to a wide range of plans and can help you understand the details, compare options, and select the most cost-effective coverage for your needs.

You can aslo seek advice from Barakat Insurance Today at:407-705-3877

Health Insurance in Florida: Facts and Figures

Understanding the health insurance landscape in Florida is crucial for residents of the state. This section provides an overview of the health insurance situation in Florida, including key providers, coverage rates, common challenges, state laws, and consumer choices.

Overview of the Health Insurance Landscape in Florida

Florida has a diverse health insurance market with several prominent providers offering a range of coverage options. Understanding the landscape can help individuals make informed decisions when selecting a health insurance plan.

Key Health Insurance Providers in Florida

In Florida, some of the major health insurance providers include:

- Barakat Insurance

- Blue Cross Blue Shield of Florida

- UnitedHealthcare

- Aetna

- Cigna

- Humana

These providers offer various health insurance plans, each with its own features, benefits, and network of healthcare providers.

Health Insurance Coverage Rates in Florida

According to recent statistics, the uninsured rate in Florida is higher than the national average. It is estimated that around 13% of Floridians do not have health insurance coverage. This highlights the importance of exploring available options and finding suitable coverage to protect against unexpected medical costs.

Common Health Insurance Challenges in Florida

Florida faces specific health insurance challenges due to factors such as a large population, diverse demographics, and the impact of natural disasters. These challenges can include limited coverage options in certain regions, affordability concerns, and navigating the complexities of the insurance market.

Understanding the Florida Health Insurance Market

To make informed decisions about health insurance in Florida, it’s important to understand the state’s laws, market competition, and available consumer choices.

State Laws and Regulations

Florida has its own regulations and laws governing health insurance. It’s essential to be aware of these laws, including requirements for coverage, consumer protections, and any mandates that may affect insurance options.

Market Competition and Consumer Choices

The Florida health insurance market is competitive, with various insurers offering a range of plans. This competition can be advantageous for consumers, as it provides more choices and potential opportunities to find affordable coverage. However, it also means individuals need to carefully compare plans to ensure they select the one that best suits their needs.

Medicaid Expansion and Access to Care

Florida’s approach to Medicaid expansion can impact access to care for individuals with low incomes. It’s important for those who may qualify for Medicaid to understand the eligibility criteria and available programs to ensure they have access to necessary healthcare services.

Here are 5 interesting facts about health insurance in Florida:

- Florida has one of the highest uninsured rates in the United States: According to data from the U.S. Census Bureau, Florida consistently ranks among the states with the highest uninsured rates. This highlights the importance of accessible and affordable health insurance options for the population.

- Florida offers a federally facilitated health insurance marketplace: In Florida, residents can access health insurance plans through the federally facilitated marketplace, also known as the Health Insurance Marketplace or the exchange. This platform provides a range of health insurance options for individuals and families, with subsidies available to help lower-income individuals afford coverage.

- Florida has a large number of health insurance companies: Florida boasts a competitive health insurance market, with numerous insurance companies offering a variety of plans. This gives residents a wide range of choices when it comes to selecting a health insurance provider and plan that suits their needs.

- Florida has unique challenges in the health insurance landscape: Due to its large population and diverse demographics, Florida faces unique challenges in the health insurance landscape. Factors such as high healthcare costs, a significant number of uninsured individuals, and specific health issues prevalent in the state contribute to the complexity of the health insurance market.

- Health insurance brokers play a vital role in Florida: Given the complexity of the health insurance landscape in Florida, health insurance brokers play a crucial role in assisting individuals and businesses in navigating the available options. These brokers have expertise in the local market and can provide personalized guidance to help consumers find the best health insurance policies that align with their needs and budgets.

These facts showcase the importance of understanding the health insurance landscape in Florida and highlight the need for accessible, affordable, and comprehensive coverage options for residents of the state.

Tips for Finding the Best Health Insurance in Florida

When searching for the best health insurance in Florida, consider the following tips:

- Researching Different Health Insurance Companies

Start by researching different health insurance companies operating in Florida. Look for providers with a strong reputation, positive customer reviews, and a wide network of healthcare providers. Check their coverage options, benefits, and customer satisfaction ratings.

- Assessing Customer Reviews and Satisfaction Ratings

Customer reviews and satisfaction ratings can provide valuable insights into the experiences of current policyholders. Pay attention to feedback regarding customer service, claims processing, and the overall satisfaction with the insurance provider.

Frequently Asked Questions (FAQs)

Here are answers to some commonly asked questions about health insurance:

Q1.What is the Open Enrollment Period, and how does it work?

The Open Enrollment Period is a specified timeframe during which individuals can enroll in or make changes to their health insurance plans. It typically occurs once a year and allows people to select new plans, switch insurers, or make adjustments to their coverage. Outside of the Open Enrollment Period, individuals may only enroll or make changes if they qualify for a Special Enrollment Period.

Q2.Can I change my health insurance plan outside of the Open Enrollment Period?

In general, you can only change your health insurance plan outside of the Open Enrollment Period if you qualify for a Special Enrollment Period. Qualifying events include significant life changes, such as getting married or divorced, having a baby, losing employer-sponsored coverage, or moving to a new state.

Q3.What is a pre-existing condition, and how does it affect health insurance?

A pre-existing condition refers to a health condition or illness that exists before obtaining health insurance coverage. In the past, individuals with pre-existing conditions faced challenges in obtaining coverage or were subject to higher premiums. However, with the implementation of certain laws, such as the Affordable Care Act in the United States, insurers are generally required to cover pre-existing conditions without charging higher premiums.

Q4.How can I find out if a specific doctor or hospital is covered by my insurance plan?

To find out if a specific doctor or hospital is covered by your insurance plan, you can:

- Review the provider directory or network list provided by your insurance company.

- Contact your insurance company directly and inquire about the coverage of a particular provider or facility.

- Reach out to the doctor’s office or hospital billing department and ask if they accept your insurance.

Q5.What should I do if my health insurance claim is denied?

If your health insurance claim is denied, take the following steps:

- Review the denial letter or explanation of benefits (EOB) provided by your insurer to understand the reason for the denial.

Contact your insurance company to discuss the denial and seek clarification on the decision.

Provide any necessary additional information or documentation requested by the insurance company.

If necessary, appeal the denial by following the insurer’s appeal process. Consider seeking assistance from healthcare. - Please note that the information provided here is for general informational purposes only and should not be taken as legal, financial, or insurance advice. It’s important to consult with a qualified professional or insurance broker to assess your specific situation and determine the best course of action regarding health insurance.

- Provide any necessary additional information or documentation requested by the insurance company.

- If necessary, appeal the denial by following the insurer’s appeal process. Consider seeking assistance from healthcare.

Please note that the information provided here is for general informational purposes only and should not be taken as legal, financial, or insurance advice. It’s important to consult with a qualified professional or insurance broker to assess your specific situation and determine the best course of action regarding health insurance.

In conclusion, health care insurance is an essential aspect of protecting both your health and your wallet. With the rising cost of health insurance, it’s important to navigate the options available to find the best plan that suits your needs. In Florida, there are several health insurance companies offering a variety of plans, and working with a health insurance broker can provide valuable guidance in selecting the right coverage.